By Leonardo Carvalho and Rafael Araújo

In a TED presentation called “How Blockchain is Changing Money and the Business World”, digital strategist Don Tapscott ranks the technology that allows for the existence of cryptocoins, such as Bitcoin, as a sort of next step into the evolution of the Internet itself.

According to him, whereas in its early stages the Internet was used as a means of transmitting knowledge and information, in this new phase the network would be transformed into an “Internet of Value”, a means of transferring values (monetary or not) without any dependence on the control of banks and other institutions, which, until today, have been the only controllers and guarantors of this type of transaction.

At the heart of this “revolution” is the solution of a problem with a complexity that is inversely proportional to the ease with which it can be understood: double-spending.

Imagine a prosaic situation in which you stop by an ice cream buggy, choose a flavor and pay for the ice cream with a money bill. At that moment, the bill is no longer under your possession, and cannot be spent again by you. It is a simple transaction, where there is no need for an intermediary to say that “the bill is not yours anymore, it now belongs to the ice cream man”. In the case of an e-commerce purchase, there is a need for a trusted third party — in this case, the financial system — to validate the transaction in order to prevent the buyer from spending the same amount more than once on different transactions, which would configure double- spending.

On the Halloween of 2008, an article was published proposing the creation of Bitcoin, an electronic cash system that can be directly exchanged among people, without the need for intermediaries. The article proposed, in short, an alternative to the current financial system. To solve the problem of double-spending, it proposed the creation of a decentralized platform (that is, that belongs to nobody), through which the transactions involving Bitcoins are audited by the participants themselves through a profitable process called mining.

Mining is a way for the Bitcoin network to reach a consensus about the carried out transactions. This is done by solving a complex mathematical calculation by the miner, which then goes through the whole network conference until its solution is validated and saved in a public transaction log called blockchain.

In the early years of the Bitcoin “experience”, its mining was something that was available to anyone, and could be carried out even on most of the household computers available at the time; however, their popularization and consequent valorization have made the process computationally more costly, both in terms of equipment needs and energy consumption. Mining machines came on the scene, gradually replacing the computers in the mining activity, increasing, then, the processing capacity. In recent years, the miners have invested heavily in the acquisition of these machines, joining them in large data centers to boost their profits and, at the same time, increasing energy consumption.

It is this increase that has raised concerns about the consequences of the mining of bitcoins (and other cryptocurrencies) in the global consumption of electricity.

The questions are: is there any reason for this concern? And, above all: is there enough data to come to any conclusion?

Energy issue makes countries and companies stand on mining

Two news from the beginning of this year have given an overview of growing attention to global energy consumption in a scenario of increased mining activities.

Earlier this month, one of Europe’s largest power companies — Italy’s Enel — stated that it had “no interest in supplying power to crypto-mine companies”. In a statement issued by Reuters, representatives of the company — which was in talks to supply renewable energy to the Swiss company of cryptomineração Envion AG — they said that they had made the decision after a series of analyzes and careful studies.

“Enel (…) sees the intensive use of energy devoted to mining as an unsustainable practice that does not fit the business model the company is seeking.”

Shortly thereafter, an article in The Washington Post stated that energy consumption by crypto-coal mining companies in Iceland is growing so much that, by the end of the year, it must exceed the energy consumption of its 340,000 citizens.

The cause of this growth? Clean and cheap energy. The country, located in the extreme north of the European continent, is rich in geothermal energy, generated from volcanoes. In addition, the low temperatures brought by the icy air coming from the Arctic reduces the need for large investments in cooling systems needed to keep the mining machines running. Combined, these two factors have made Iceland the preferred destination of companies involved in this activity. “Five years ago there was a lot of talk about installing data centers around here. But in the last six months the interest peaked. We are getting a daily phone call from foreign companies interested in setting up here”, said Johann Snorri Sigurbergsson, a representative of energy company HS Orka, to the Washington Post. “If all these projects come to fruition, we will not have enough energy,” he added.

In both cases, energy consumption is far from negligible, but would it really have catastrophic potential?

Statistics show real risk of shortages

Data released by Digiconomist — a website created in 2014 by financial advisor Alex de Vries as a “platform for in-depth analysis related to Bitcoin and other crypto coins” — points to an “alarming” scenario for energy consumption specifically related to Bitcoin.

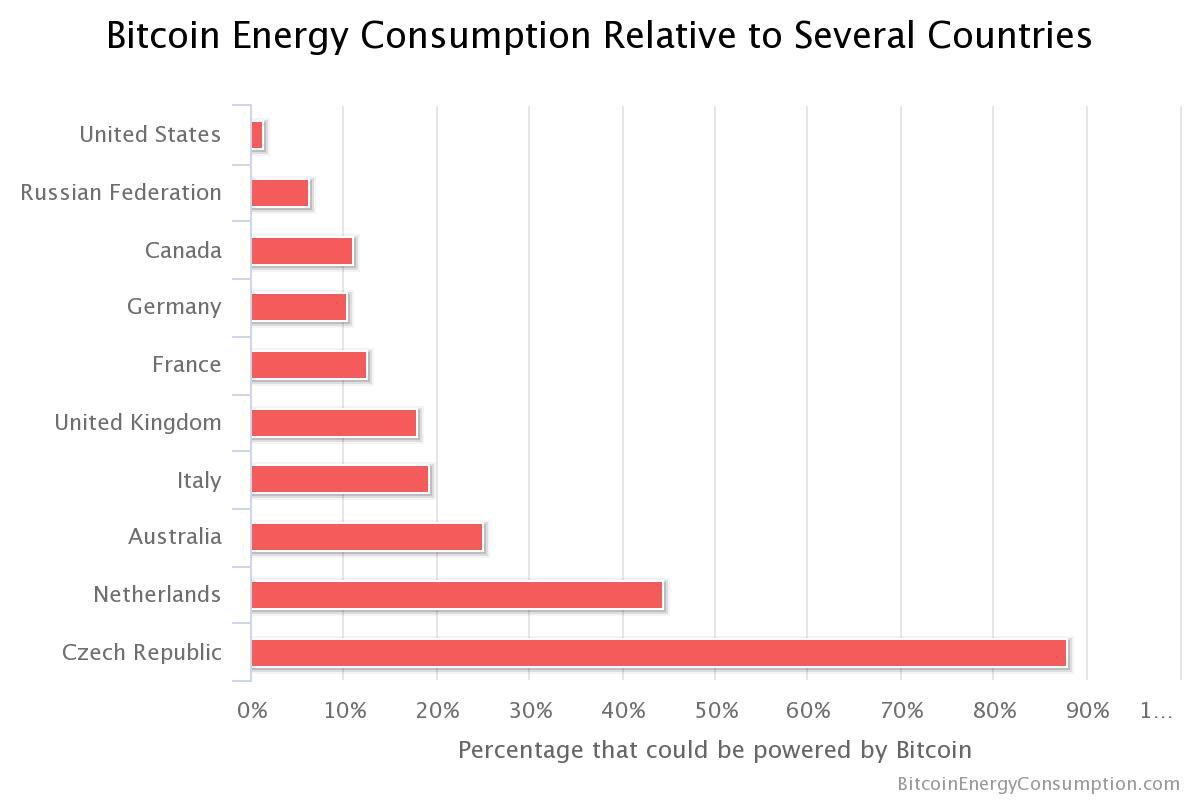

According to data from November 2017, annual electricity consumption to mine this single cryptocoin was estimated at 29.05 TWh (Terawatts / hour), equivalent to 0.13% of total global electricity consumption, comparable to the consumption of 159 countries taken isolatedly. According to the website, the growth rate of energy consumption related to crypto-coal mining reached almost 30% between the months of December / 2017 and January / 2018.

Extrapolating data from the Digiconomist, another site — Britain’s Powercompare — warns that, if this rate is maintained, Bitcoin’s mining will be able to consume the equivalent of all the electricity produced in the world today, by 2020.

Another analysis, produced by Credit Suisse, and also restricted to Bitcoin, considers that, because of the value attributed to the currency rises, new investors will be attracted and, consequently, the amount of energy that is spent to mine it will increase. The bank estimated that, if Bitcoin reached the level of US $ 50,000, the energy consumption used in its mining would be multiplied by 10. If, hypothetically, it was widely adopted to reach a price of US $ 1.1 million, it “would be profitable enough to use almost all the electricity currently generated in the world.”

Not a few people, however, see misunderstandings and exaggerations in these estimates.

Experts consider Digiconomist data “insufficient”

An article published last December on CNBC´s website calls for caution in interpreting the numbers presented by the Digiconomist, and criticizes its rapid acceptance by journalists, media companies and market analysts.

According to the article, “there is no doubt that there is a question of efficiency in the mining process … but we are learning that the consumption estimates [presented by the Digiconomist] may be flaws, and have been used to make assumptions of extreme extrapolation, seen in the past whenever new technologies emerge.”

A number of energy experts heard by CNBC agree that “there is currently no reliable way to measure how much energy is consumed in the mining process.”

Christian Catalini, an assistant professor at MIT’s Sloan School of Management, and a cryptocurrency scholar and blockchain tech, is one such expert. According to him, to measure such consumption, it would be necessary to collect data from data centers, something that nobody has done so far: “I do not believe that it is possible to make any assertion about the use of electricity for bitcoins mining without considering the data of the miners themselves”, he said.

Ericsson Research’s senior sustainability specialist, Jens Malmodin, considers it reckless to point out — as the Digiconomist did — that power consumption by miners is roughly double the combined consumption of Google, Microsoft, Facebook, Amazon and Apple. For him, “this number is simply not realistic.”

New technologies and consumption balance

Another scholar on the subject, heard by CNBC, was Stanford University lecturer James Koomey. A veteran on the topic of energy consumption by new technologies, Koomey was part of a team of researchers who denied alarming projections about the Internet’s energy consumption in the mid-1990s.

At the time, as in the case of Powercompare, a classic mistake was made, he said, “they forecast the high growth rates associated with new technology in the future, resulting in a demand for eyes. “ And he recalls: “Similar projections have been made about Internet data traffic and the use of electricity by computers in offices and on mobile devices. As the scale in the use of these technologies has grown, consumption rates have been more moderate.”

Another issue that is not considered in these projections is the evolution of technologies directly involved in mining. We will take as an example two generations of a mining machine: Bitman Antminer.

In its S7 version — released in mid-2015 — the power consumption was 0.25 W / Gh (Watts per Gigahash). The S9 version, released two years later, consumed 0.098 W / Gh. Focusing only on the consumption of the miners themselves, and without considering energy costs related to refrigeration, there was a 250% improvement in equipment efficiency.

Yet, another issue not taken in account in these projections are solutions that may indirectly impact on energy consumption.

One is related to the already mentioned “methods of consensus”, which are at the very heart of the mining process. It is possible to affirm that the more complex the method of consensus to validate a given transaction, the greater will be the computational (and consequently, electric) energy expended in the operation. It is well known that many researchers have been working on new, more efficient, consensus methods, which, if adopted, would reduce energy consumption.

A second, indirect solution, is the creative development of technologies that make consumption more efficient, without directly impacting on mining.

In Canada, an entrepreneur named Bruce Hardy has found a way to recycle the heat generated by mining equipment to produce vegetables and even fish. Hardy has 30 mining platforms distributed in just over 20,000 square feet. The heat generated by the platforms circulates around the environment, heating greenhouses with plants and fish tanks. Hardy, who mined bitcoins two years ago, initially invested in refrigeration systems for the equipment until he realized that the heat could be dissipated and used in agriculture.

While, on the one hand, the growth trend in mining activity and energy consumption is a reality, it is to be expected that creativity, if not the very evolution that makes technologies more efficient as their use gains in scale, will bring new solutions to the energy issue — just as it has in other technological movements and trends in the past.